According to Bloomberg, citing people familiar with the matter, the two companies have so far failed to agree on a price in talks to acquire Seagen. Negotiations could still resume, however, and could be reached. If talks go through, it could be the drug giant’s biggest deal in more than a decade.

A spokesman for Seagen declined to comment, and a representative for Merck did not immediately respond to a request for comment.

In early July, The Wall Street Journal reported, citing people familiar with the matter, that Merck was in advanced talks to acquire Seagen and planned to reach an agreement to buy the cancer biotech company in the coming weeks. And revealed that the total amount of the deal could be around $40 billion or more.

As early as June 18, 2022, according to the Wall Street Journal, Merck is considering acquiring Seagen, the leading ADC company.

Merck and Seagen have previously collaborated. In September 2020, Merck introduced the LIV-1-targeting antibody-drug conjugate (ADC) ladiratuzumab vedotin, with a total transaction value of $4.5 billion, including a $600 million down payment, a $1 billion equity investment, and a maximum of $2.6 billion in mileage. At the same time, Merck acquired the rights to commercialize the tyrosine kinase inhibitor tucatinib in Asia, the Middle East and Latin America, and other regions (outside the U.S., Canada and Europe) for $190 million.

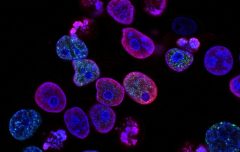

Seagen is a leader in the ADC field. Currently, 4 new ADC drugs (3 independent research and 1 cooperative development) have been approved for marketing, and there are many new ADC drugs under development. In 2021, the sales revenue of the listed products for Seagen will be 1.38 billion US dollars.

It is worth mentioning that on August 8, 2021, Seagen introduced the new HER2 ADC drug Vidicitumab from Rongchang Bio, with a total amount of up to US$2.6 billion, including a down payment of US$200 million, milestone payments of up to US$2.4 billion and sales commissions.

For Merck, even if the deal doesn’t go through, it still has a strong presence in oncology — the company already owns Keytruda, one of the world’s best-selling cancer drugs, but Merck is too reliant on it.

It is understood that Merck’s largest ever acquisition was the $47 billion acquisition of Schering-Plough in 2009.